How to use:

Score each section from 1 (Low Risk) to 5 (High Risk)

At the end → Use Risk Interpretation Matrix.

SECTION 1 — EGO vs REALITY

Key Question: Does the founder seek truth or validation?

Indicators:

- Cannot accept being wrong

- Rejects uncomfortable data

- Believes vision > evidence

- Blames market, team, investors — never self

- Talks more than listens

- Overuses words like “inevitable”, “revolutionary”, “guaranteed”

Score (1–5): ___

SECTION 2 — COACHABILITY

Key Question: Can this founder evolve?

Watch for:

- Implements feedback fast

- Asks sharp questions

- Seeks mentors proactively

- Changes mind when evidence changes

- Not defensive when challenged

Red flag:

Smart but uncoachable founders are startup suicide machines.

Score (1–5): ___

SECTION 3 — EXECUTION vs STORYTELLING

Key Question: Builder or talker?

Signs of risk:

- Pitch stronger than product

- Narrative ahead of traction

- Constant fundraising vs shipping

- Deck updates > product updates

- Vanity metrics obsession

Score (1–5): ___

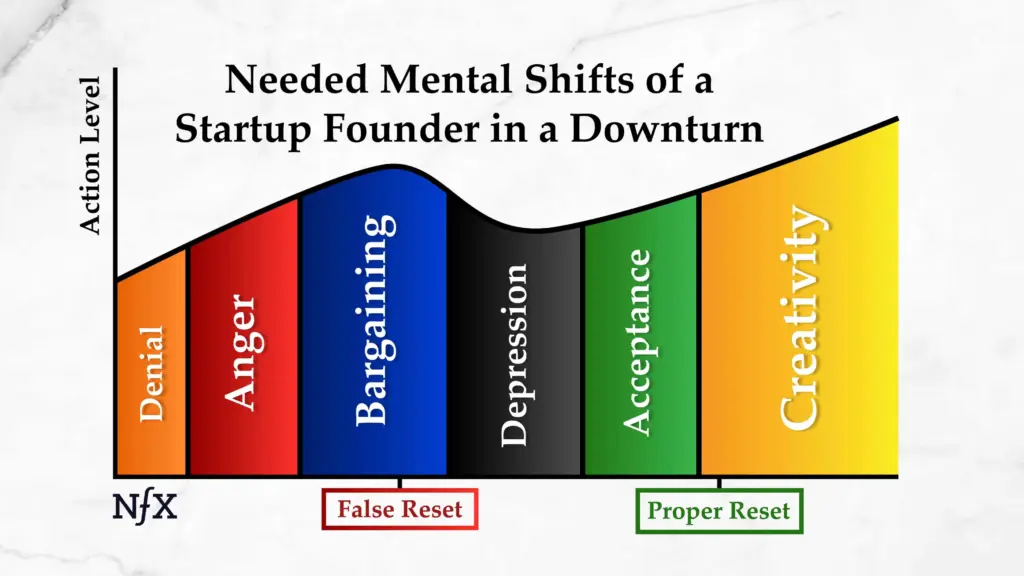

SECTION 4 — STRESS & EMOTIONAL STABILITY

Startups = prolonged psychological war.

Check:

- Handles setbacks calmly

- Decision quality under pressure

- Emotional volatility

- Panic behaviour in crisis

- Burnout signals

- Impulsive pivots

High risk founders:

- Oscillate between euphoria ↔ despair

- Make emotional decisions disguised as strategy

Score (1–5): ___

SECTION 5 — INTEGRITY & TRUTHFULNESS

Non-negotiable zone.

Detect:

- Data manipulation

- Selective disclosure

- Cap table opacity

- Hidden liabilities

- Revenue inflation

- Excuses instead of facts

If integrity doubtful → Stop. No investment.

Score (1–5): ___

SECTION 6 — CONTROL vs TRUST

Founder risk rises if:

- Cannot delegate

- Micromanages everything

- Distrusts team

- Needs total control

- Fear of being replaced

Paradox:

Control freak founders slow growth → then blame market.

Score (1–5): ___

SECTION 7 — MONEY PSYCHOLOGY

Danger signals:

- Treats funding like personal success

- Overspends after raise

- Ego hiring

- Vanity branding

- Burn blindness

- Avoids unit economics

Frugal founders survive longer.

Score (1–5): ___

SECTION 8 — MOTIVATION TYPE

Identify primary driver:

| Type | Risk |

| Mission-driven | Low risk |

| Builder mindset | Low risk |

| Wealth obsession | Medium risk |

| Status / fame driven | High risk |

| Fear-driven | High risk |

Score (1–5): ___

SECTION 9 — REALITY DISTORTION INDEX

Check if founder:

- Believes market will “understand later”

- Ignores weak traction

- Constantly reframes failure as strategy

- Confuses hope with probability

- Lives in future narrative vs present reality

Score (1–5): ___

SECTION 10 — FAILURE RESPONSE

Ask: “Tell me about your biggest failure.”

Evaluate:

- Takes responsibility?

- Learned clearly?

- Changed behaviour?

- Still bitter / blaming?

Past failure response predicts future crisis behaviour.

Score (1–5): ___

RISK INTERPRETATION MATRIX

Total Score = ___ / 50

| Score | Founder Risk Level | Meaning |

| 10–18 | LOW RISK | Investable. Strong psychological base |

| 19–26 | MODERATE | Coachable but monitor |

| 27–34 | HIGH | Governance protection needed |

| 35–42 | VERY HIGH | Replace risk likely |

| 43–50 | EXTREME | Avoid investing |

CRITICAL RED FLAGS (Immediate Stop)

If any present → Do not invest

- Integrity doubts

- Lies about metrics

- Blames everyone else

- Cannot handle truth

- Emotionally unstable

- Ego > company survival

WHAT GREAT FOUNDERS LOOK LIKE (Pattern Recognition)

Elite founders usually:

- Seek truth, not validation

- Calm under chaos

- Ruthlessly honest with numbers

- Frugal even after funding

- Coachable but independent

- Ego controlled, ambition high

- Execute more than speak

- Adapt fast, panic slow